estate tax exclusion amount sunset

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. This record-high exemption limitation is set to sunset in 2025 but it could be changed by new legislation prior to that date.

9 Estate Planning Resolutions For The New Year Buckley Law P C

For more information about this and other TCJA provisions visit IRSgovtaxreform.

. Part 3 of 3 - Sunset and Clawback. The IRS issued taxpayer-friendly regulations on how to calculate the applicable exclusion amount when calculating estate and gift taxes once the higher exemption amounts sunset after 2025. The option of portability that existed before the TCJA continues meaning that through proper planning a married couple can maximize their use of the exemption.

A dies in 2026. We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable. Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9 million of BEA that was used in 2018.

Couples can pass on twice that amount or 228 million. You can gift up to the exemption amount during life. Temporary 100 cost recovery of qualifying business assets.

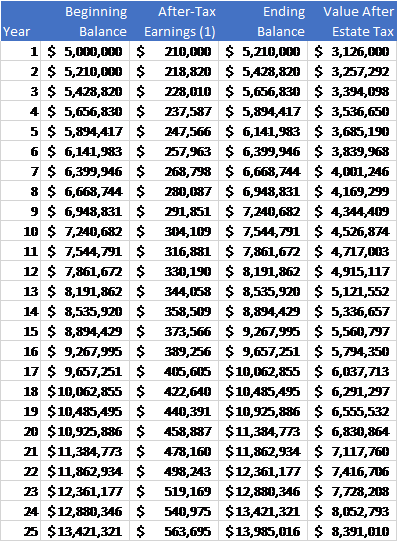

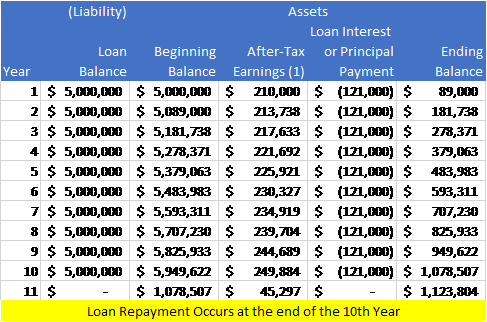

Assume that a family is worth well in excess of the current estate tax exemption of 22800000 and that they reside in a state with no current estate or inheritance tax. A uses 9 million of the available BEA to reduce the gift tax to zero. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025.

Its basically 11 million plus inflation adjustments. A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax. However the amount of property that can be transferred to children and others without estate tax is limited.

This resulted in a unified lifetime exemption of 11400000 in 2019 and 11580000 in 2020. As the IRS released on November 22 2019 The Treasury. The Federal Estate Tax Exemption.

For estates of decedents dying and gifts made after Dec. For 2017 the federal amount exempted from death taxes is 549 million and the top federal estate tax rate is 40 percent she said. Married couples potentially can exclude twice that amount or 24120000.

The lowest exemption in US. Estates in excess of the exclusion are currently taxed at 40. The exemption remained at 50000 until 1926 when it was raised to 100000.

The amount is 1118 million for an individual in 2018 and 2236 million dollars for a married couple. In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. For 2022 the lifetime individual estate and gift tax exemption is 1206000.

Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. 2020 Federal Gift and Estate Tax Rules and Analysis. The exemption amount gets adjusted each year and if no change in the law is made it will increase to approximately 12060000 in 2022.

Because the exclusion amount is back to 115 million your estate tax is 46 million. A federal estate tax is imposed only on that portion of the estates value that exceeds the exemption amount said Shirley Whitenack an estate planning attorney with Schenck Price Smith King in Florham Park. Theres also the annual gift tax.

The estate tax due would be zero. The current exclusion is 5450000 under federal law 4187500 in New York and 675000 in New Jersey. Its 1158 million for deaths occurring in 2020 up from 114 million in 2019.

By Megan Russell on September 3 2020. Under current law the estate and gift tax exemption is 117 million per person. Every dollar over 22800000 is really only worth sixty cents.

You may recall that the 2017 Republican tax reform legislation roughly doubled the estate and gift tax exemption. Because the estate tax is 40 of the amount in excess of the exemption amount. 31 2017 and before Jan.

But if you give anyone more than that amount in a single calendar year youre supposed to report the excess on a gift tax return. Under current law the estate and gift tax exemption is 117 million per person. The Sunset Provision of the Temporary Increase in Estate Tax Exemption.

The Tax Cuts and Jobs Act in 2017 provides that the estate tax exclusion amount is 10 million adjusted for inflation through 2025 will revert back to 5 million adjusted for inflation for people who pass away in 2026 and beyond. In 1932 the exemption dropped back to 50000. Importantly the current doubled base exemption value of 10000000 is slated to sunset meaning that it will revert to 5000000 effective January 1 2026 unless Congress acts to extend current law.

The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for married couples. The federal estate tax exemption is indexed for inflation so it increases periodically usually yearly. The Tax Court held that the value of a farm a decedent transferred to a family limited partnership was includible in the decedents estate because the decedent retained the.

The annual gift tax exclusion is 16000 in 2022. This means starting in 2019 people are permitted to pass on tax-free 114 million from their estate and gifts they give before their death. Estate and gift tax retained with increased exemption amount.

The current lifetime estate exclusion amount is 11700000 per taxpayer or 23400000 for a married couple. 1 2026 the Act doubles the base estate and gift tax exemption amount from 5 million to 10 million. A person can give an unlimited amount of property to their spouse or to charity without any gift or estate tax.

This means that each year you can give 16000 to as many individuals as you like with neither you nor the recipient having to report the gifts to the IRS. Estate tax history was 40000 from 1935. You can gift up to the exemption amount during life or at death or some combination thereof tax-free.

How 2026 Sunset Laws Will Impact Your Tax Cuts Federal Employee Tax Planners

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

Burning Sunset Saguaro National Park Arizona Law Offices Of David L Silverman

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

What Is The New Residential Property Tax Being Considered In Hawaii Mansion Global

Tax Tips For Military Personnel With Income From Rental Properties Article The United States Army

/landscape-with-winding-river-at-sunset-1068087040-7cbd1d12e9ca498294dd6423f46f53c1.jpg)